Elecnor has earned EUR 30.5 million in the first quarter, 11.2% higher than in the same period in 2023

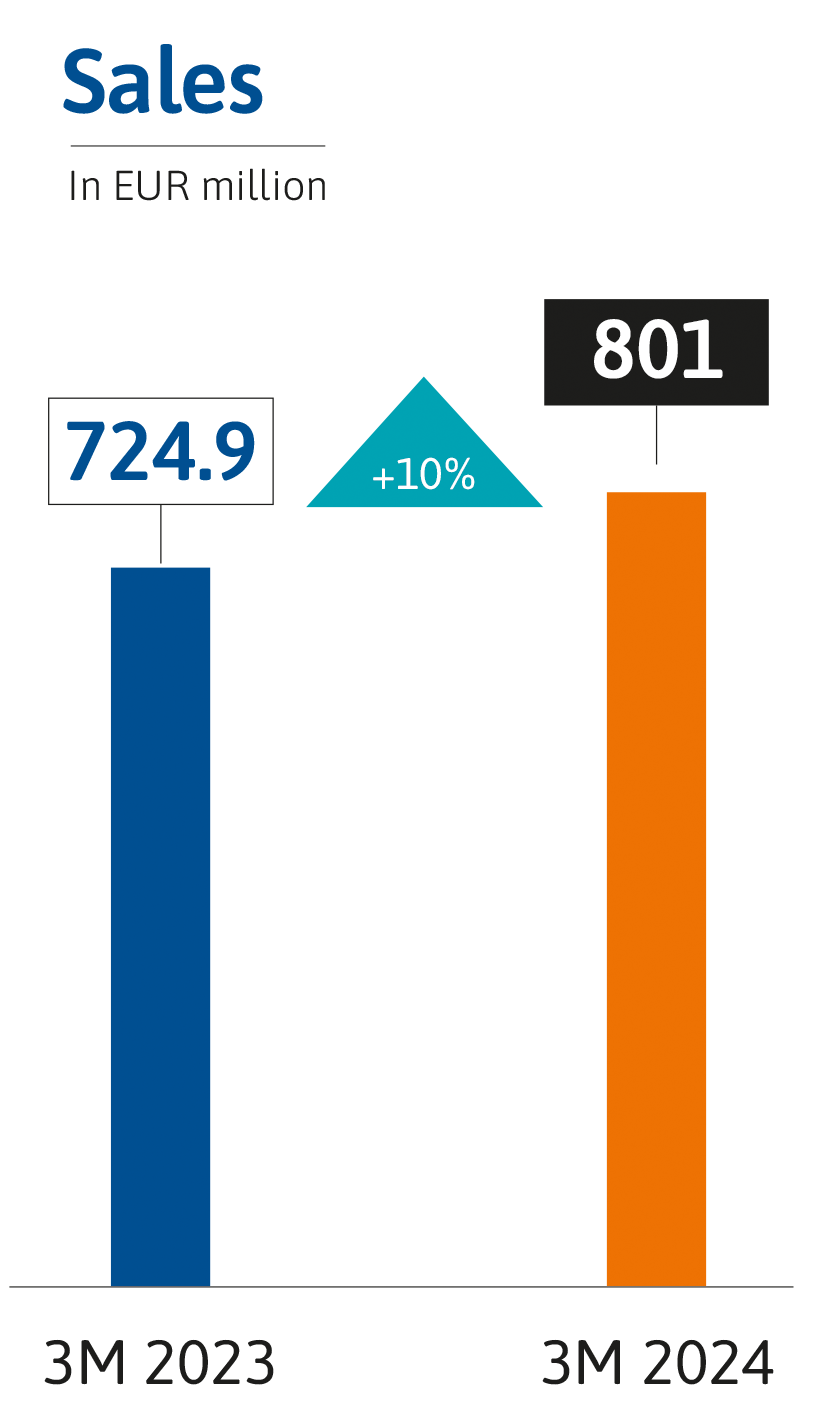

The company has achieved a turnover of EUR 801 million, 10.5% higher than the figure reached in the first three months of the previous year

The Elecnor Group has achieved a consolidated net profit of EUR 30.5 million in the first quarter of 2024, which represents a 11.2% increase on the figure reported in the same period of the previous year. In turn, sales stood at EUR 801 million on 31 March 2024, which means an improvement of 10.5% compared to the same period the previous year.

The international market, accounting for 56% of the total, has recorded a remarkable increase of 20.4% in relation to the first quarter of the previous year, while the domestic market has remained at a similar level to 2023.

Elecnor (Essential Services and Sustainable Projects)

In a breakdown by area of Business, the turnover of Elecnor (Essential Services and Sustainable Projects) has risen by 5.2%, to EUR 805.8 million, while its attributable net profit has reached EUR 21.9 million (+4.4%), with a positive performance during the first three months of this year.

In the domestic market, the pattern of growth in activity has continued due to the essential services performed for the sectors of electricity, telecommunications, water, power transmission and distribution, fields where the company provides an essential service to all the utilities. Furthermore, mention should be made of the maintenance activity carried out for both the public and private sectors. Likewise, as part of the activity of sustainable projects, of note are the construction projects for wind and photovoltaic power farms and those related to self-consumption and energy efficiency.

In the international market, the positive tendency in turnover is mainly down to the sustainable projects that the Group is carrying out in Brazil and Chile (particularly in renewable energy and electric power transmission lines). The growth of the Group’s turnover and earnings has also been boosted by the construction of solar photovoltaic power plants in the Dominican Republic, wind farms in Brazil, hydroelectric power stations in Cameroon, substations in Mozambique, and Gambia, and power transmission lines in Chile, Zambia and Angola. Also noteworthy in these figures is the activity of essential services conducted by the US subsidiaries (Hawkeye, Belco and Energy Services), as well as the distribution and telecommunications contracts that Elecnor is executing in Italy.

>

>

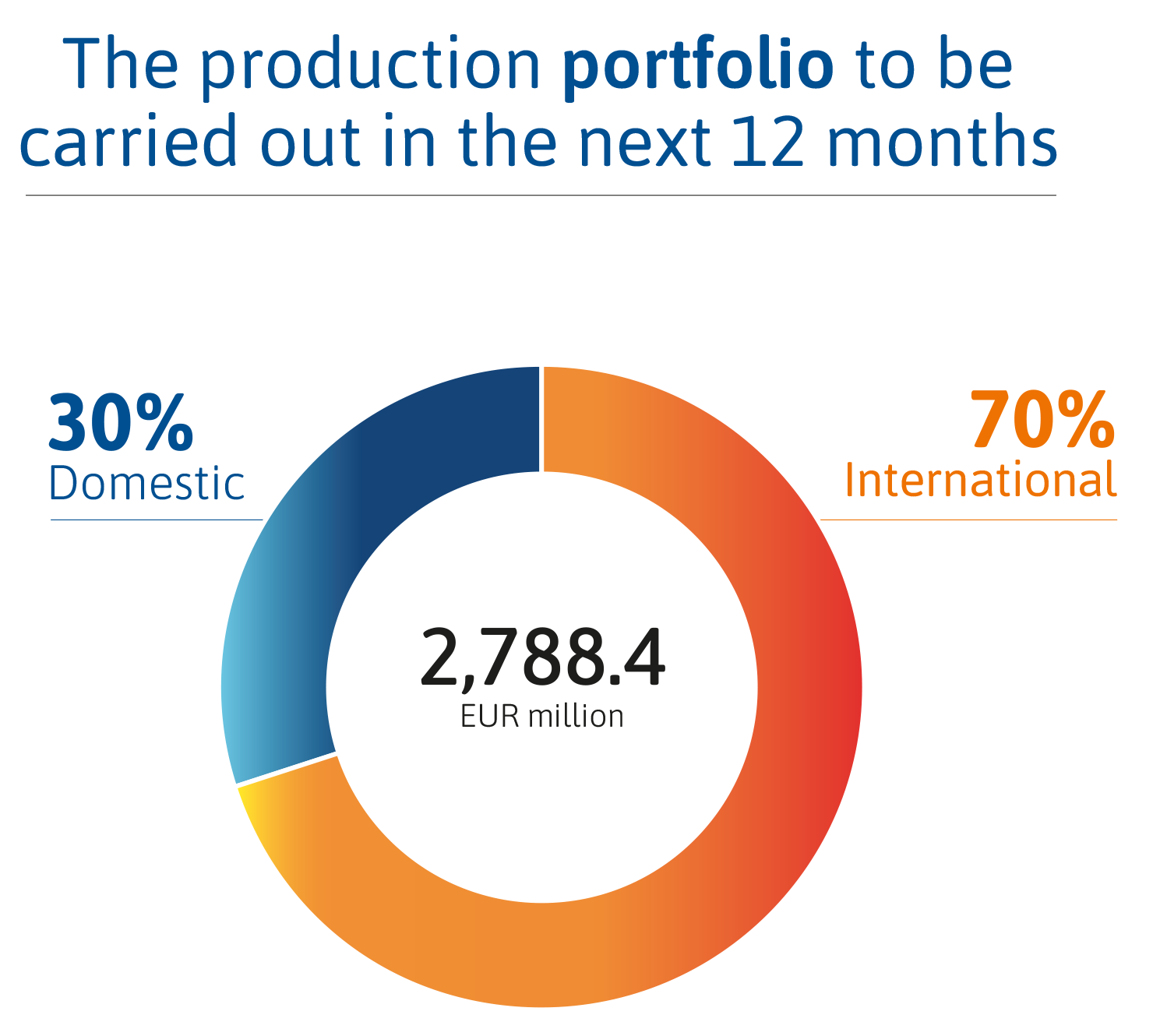

The production portfolio of projects due to be executed in the next 12 months amounts to EUR 2,788.4 million (compared to EUR 2,577.7 million at the end of 2023). The international market accounts for 70% of this portfolio figure, amounting to EUR 1,962.2 million and 30% comes from the domestic market, amounting to EUR 826.2 million. The domestic market portfolio is composed of contracts for activities relating to essential services, as well as sustainable construction projects for renewable energy power plants. The international portfolio is based on contributions both from European countries (Italy and the United Kingdom) and the United States, where activities relating to services are carried out, as well as from other countries (mainly the Dominican Republic and Brazil) where contracts have been awarded for significant projects involving the construction of renewable power plants and power transmission.

Celeo

Celeo, a company that is 51% owned by the Elecnor Group and jointly managed with APG, has stakes in 7,942 km of electricity power transmission lines in Chile, Brazil and Peru, both in use and under construction (the same figure as at the end of 2023), as well as 345 MW of renewable energy (photovoltaic and thermosolar) in Spain and Brazil. The combination of assets in operation that the company manages comes to about EUR 6,317 million at year end.

Celeo’s Transmission Networks business has performed well this quarter compared to the same period of the previous year, as it was boosted by the increase in price indexes that affect the sales rates applicable to power transmission lines, which had a particular impact on the Brazilian projects, and the appreciation of the Brazilian real, the currency used for a great deal of its business. Celeo is consolidated in the Group accounts by means of the Equity Method, so consequently no sales figures are included. In this period, the company has posted a consolidated attributable net profit of EUR 2.8 million (compared to 2.7 million the previous year).

Enerfín

As part of the Elecnor Group’s strategy of rotating investments that need large amounts of capital, the company has signed a contract with Statkraft for the sale of 100% of its shares in Enerfín. In the aforementioned contract (signed on 17 November 2023), the value of the company is estimated at EUR 1.8 billion, with cash earnings of 1.4 billion and net consolidated capital gains of 0.8 billion. It is expected that this operation will be completed before the end of the first semester of 2024 and up to this date the assets and liabilities of the Enerfín subgroup will be classified under the heading Non-current Assets and Liabilities held for sale and the resulting income will be classified as Profit/Loss from Discontinued Operations in the Group’s profit and loss account, as in 2023.

The consolidated attributable net profit generated by this deal in the first quarter of the year comes to EUR 6.7 million compared to 5.7 million the previous year.

Strategy linked to sustainability

The Elecnor Group’s Strategic Plan for Sustainability 2023-2025 reflects the Group’s firm commitment to people, society and the environment, based on constant ethical and responsible management. The 6 strategic axes focus on value creation and the generation of an environmental, social and governance-based dividend. The major milestones of the Plan include:

» Certification for the second year running of the Corporate Social Responsibility Management System in accordance with IQNet SR10 standard. This certification confirms that the Elecnor Group has an effective Corporate Social Responsibility Management System with all the necessary elements to manage sustainability properly, thereby acting as a guarantee of its level of commitment to this issue.

» 73% of the corporate financing is sustainable through being linked to the achievement of ESG goals and indicators.

» Boosting renewable energy projects, adding new hybridisation and green hydrogen projects to traditional technologies.

» Consolidation of its position of Leadership in the initiative by the CDP (Carbon Disclosure Project), one of the highest levels in terms of sustainability, adaptation and mitigation in the fight against climate change.

» Ongoing deployment of the Integrated Management System in the international area.

» In Health and Safety, the frequency rate has been upheld, the best since records began, strengthening commitment to the goal of zero accidents in the workplace.

» The rate of Digital Transformation has reached 97%.

Outlook for 2024

The activities that the Elecnor Group performs will benefit from three major trends forecast to drive worldwide economic development:

• Environmental and social sustainability

• Energy transition and electrification of the economy

• Urban development and digitalisation of society

On the basis of the sound contract portfolio, as well as the geographical diversification and the excellent workforce at the Elecnor Group, during this fiscal year the Group’s business activities are expected to exceed the sales figures and earnings from ongoing operations achieved in the previous year, just as it has been doing year after year for the last decade.