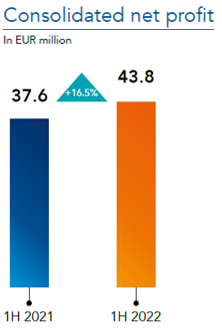

The Elecnor Group's net profits reach 43.8 million euros in the first half of 2022

This is a 16.5% increase over earnings in the first half of 2021

The Elecnor Group has continued the strong first quarter trend to close the first half of 2022 with a consolidated net profit of 43.8 million euros, growing 16.5% over the 37.6 million for the same period last year.

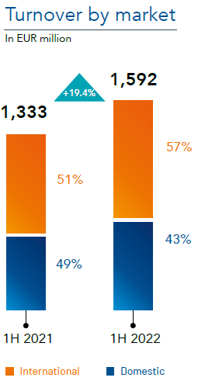

Through 30 June 2022 the Group's consolidated sales totalled 1,591.9 million euros, that is, 19.4% higher than in the first half of 2021. Both the national market (43% of the total) and the international market (the other 57%) experienced strong growth, 6.2% and 32%, respectively.

The Group's EBITDA was 145.6 million euros, 29.7% higher than in the same period in the previous year. Elecnor's business (Services and Projects) is not the only area that has been strong. Enerfín's business, chiefly its wind farms in Spain, has also seen positive growth.

The Group manages its activities through Elecnor (Services and Projects), Enerfín and Celeo (Infrastructure and Renewable Investments), businesses that complement and strengthen each other.

Elecnor (Services and Projects)

In the domestic market, activity continued to grow thanks to the services developed in the energy, telecommunications, water, gas and transport sectors, where the Division provides an essential service for all utilities. Likewise, both the construction and development of wind and photovoltaic farms, as well as the refurbishment and maintenance projects related to self-consumption and energy efficiency, have contributed to the growth of the Group's revenue and profit.

In the international market, the positive performance is largely due to the large projects in Australia being developed during the year, the construction of power transmission lines in Brazil and Chile, as well as the US subsidiaries (Hawkeye and Belco).

Revenues were 1,490 million euros, a 17.6% rise, with attributable consolidated net profits growing by 18.4% to 41.2 million euros.

As of 30 June, Elecnor's portfolio of firm contracts for pending work to be carried out in the next 12 months is 2,390.7 million euros (compared with 2,291.5 million at the end of 2021), continuing its upward trend. The international market accounts for 72% and the national market 28% of this amount. The national market portfolio consists of contracts for traditional service activities. The international portfolio has increased both in Europe (Italy and the United Kingdom), where service-related activities are carried out, and in other countries (mainly Australia, Chile, and Brazil), where there are contracts for major renewable energy power generating projects and power transmission projects.

Enerfín

Enerfín has stakes in 1,355 MW of renewable power in operation and in construction in Spain, Brazil, and Canada and is continuing its extensive development activity to assure further growth and expand its pipeline, currently nearly 9 GW of wind power and photovoltaic projects. It is continuing to diversify its activities by branching out into energy storage and hybrid and hydrogen energy projects.

Enerfín closed the first six months of the year with sales of €105.3 million, 54.4% more than in the same period of 2021, while its EBITDA stood at €71.9 million, 61.4% higher than in the first half of last year. This positive performance was mainly due to higher production compared to the previous year at wind farms in Spain and at a more favourable price. On the international front, the San Fernando complex in Northeast Brazil came into operation at the beginning of last year, as well as the positive performance of the Brazilian real and the Canadian dollar against the euro, currencies in which the company operates abroad.

Celeo

Celeo operates 6,891 km of power transmission lines in Chile and Brazil and has stakes in 345 MW of renewable energy. The operating assets managed by the company (co-owned and co-managed by APG, one of the world's largest pension funds) total some 5,211 million euros.

In the first half of this year it contributed an attributable consolidated net profit of 4.1 million euros. Celeo's power transmission network business has grown thanks to entry into operation of the concession in Serra de Ibiapaba in Brazil in late 2021 and the strength of the U.S. dollar and Brazilian real against the euro. On the other hand, output by the solar thermal plants Celeo manages in Spain has fallen because of low thermal resources during the period. This is a seasonal factor that will be corrected in the coming months, when thermal resource levels will be higher.

2022 Forecasts

The Elecnor Group retains its position as leader in electrification and energy efficiency, renewable energies, digitisation and connectivity, and comprehensive urban services. These activities will drive future growth and will benefit from the brunt of the stimulus measures offered by the European Union and the United States.

Accordingly, based on its good performance in the first six months of the year, the Elecnor Group expects to see continued growth by all the main factors contributing to its bottom line for the rest of the year, as it has been doing year after year for the past decade.

In the words of Rafael Martín de Bustamante, CEO of the Elecnor Group, “Forecasts for the next year predict a downturn in growth worldwide as a result of potential mutations by the COVID virus, climbing interest rates, sustained inflation, and the war in the Ukraine. Nevertheless, we place our trust in the expertise and hard work of our teams, and we expect to continue along the upward trend in the coming months as we have in previous years”.

Sustainability you can count on. A firm ESG commitment